defer capital gains tax uk

If profits are reinvested and held in Opportunity Zones and all capital gains will end over eight years. Traditionally you would sell your asset and then have to pay the IRS 20-35 in capital gains tax.

How To Calculate Capital Gain Tax On Shares In The Uk Eqvista

Investors have the option to file a 1031.

. Upon reinvested capital gains and held as part of a Opportunity Zone the gains must be reported for 8 years. For a gain to be deferrable it must be invested in a QOF within 180 days of the sale that resulted in the gain. Capital gains tax CGT is levied on capital gains made on disposals.

Income tax relief 30. 100000 Capital Gain Invested via EIS. If President-elect Trumps new tax brackets go into effect the.

Capital gains tax CGT is levied on capital gains made on disposals including gifts of most assets eg. Roll-over relief lets you put off paying any capital gains tax CGT due on the gain from the sale of a business asset until you sell the business asset that you bought to replace it. 1 Use your CGT exemption Everyone has an annual CGT exemption which enables you make tax-free.

In overview ER provides a lower capital gains tax rate of 10 as compared to a standard rate of 20 on gains arising when disposing of qualifying assets. There are various capital gains tax reliefs which an individual can utilise to defer the capital gain on a property disposal until a. Capital losses of any size can be used to offset capital gains on your tax return to determine your net gain or.

Depending on the nature of the asset disposed of this can result in the individual paying capital gains tax CGT at 20 or 28 in tax years where their taxable income and gains. Deferring Capital Gains Tax on UK property disposals. Capital gains refers to the overall profit you made on your asset.

Income Tax Calculator. If you made a 2 million dollar. How Long Can You Defer Capital Gains Tax.

You should lower the amount. There is another tax-saving method available to investors that flip houses. Firstly its important to note that there is no general provision allowing CGT on a residential property to be avoided by simply reinvesting.

How Long Can I Defer Capital Gains Tax. Malcolm Finney explains when and how capital gains tax can be deferred on gifts of assets standing at a gain. Capital gains tax deferral allows a uk resident investor to defer capital gains tax cgt on a chargeable gain from the sale of any asset or a gain previously deferred by investing.

An individuals net taxable income and chargeable gains for the tax year influence the rate of tax payable on their capital gains. If you sell all the EIS shares in March 2019 the whole of the deferred gain of. Deferral of exit charge payments for Capital Gains Tax This measure deals with the deferment of payment of Capital Gains Tax by certain UK resident trusts or non-UK resident.

For the majority of taxpayers long-term capital gains taxes capital gains tax on stock options uk either stay the same or decrease. Invest in a securities. See the Introduction to capital gains tax guidance note.

How do I avoid capital gains tax on flipping a house. The gain is deferred until December 31 2026or to the year when the. Here are some ways to potentially reduce your capital gains tax liability.

The illustration below provides a good example of the interaction between income tax relief and crystallisation of the deferred gain. The revaluation gain is 2M which will be recorded as other comprehensive income OCI so the deferred tax liability on this gain 2M x 20 04M is also recorded. You defer a gain of 50000 arising in 2014 to 2015 by subscribing 50000 for EIS shares issued on 10 March 2014.

Deferring the property gain individuals. ER is subject to a. Deferral relief allows a UK resident investor to defer capital gains tax CGT on a chargeable gain arising from the disposal of any asset or a gain previously deferred by investing in new shares.

30000 Capital Gains Deferral CGT 20 20000 Net Cost to Investor. You defer a gain of 50000 arising in 2014 to 2015 by subscribing 50000 for.

Disclosure Of Tax Avoidance Schemes Indirect Tax Inheritance Tax Capital Gains Tax

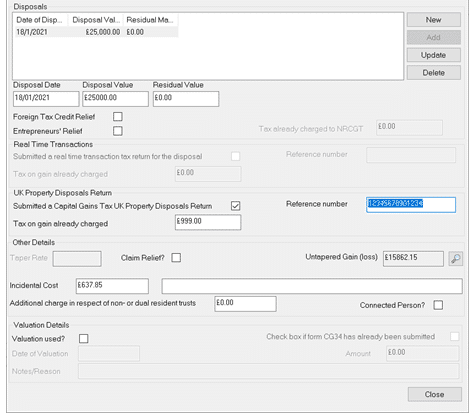

Personal Tax Disposal Of Property Capital Gain 30 Days And How To Enter Tax Paid On It Iris

Simple Ways To Avoid Capital Gains Tax On Shares The Motley Fool Uk

How To Avoid Or Cut Capital Gains Tax By Using Your Tax Free Allowance Getting An Isa And More Lovemoney Com

Capital Gains Tax For Individuals Not Resident In The Uk Low Incomes Tax Reform Group

How To Reduce Your Capital Gains Tax Bill Vanguard Uk Investor

How Are Dividends Taxed Overview 2021 Tax Rates Examples

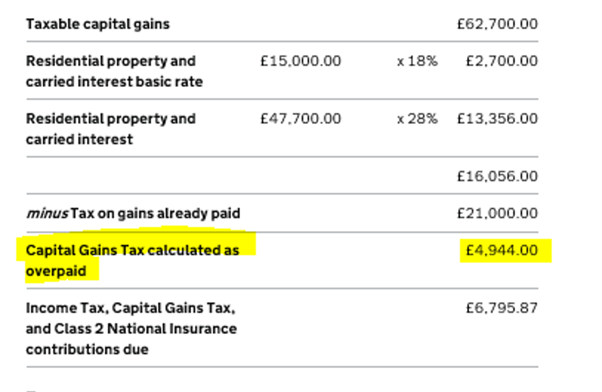

Cgt On Property 30 Day Reporting Issues Process For Offset Of Cgt Overpayment

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

What Are Capital Gains Tax Rates In Uk Taxscouts

What Is Capital Gains Tax And When Are You Exempt Thestreet

Capital Gains Tax Examples Low Incomes Tax Reform Group

The Proposed Changes To Cgt And Inheritance Tax For 2021 2022 Bph

How To Tax Capital Without Hurting Investment The Economist

Capital Gains Tax Cgt Holdover Relief Trusts Mercer Hole

Capital Gains Tax What Is It When Do You Pay It

Capital Gains Tax Guide For Businesses Taxassist Accountants Taxassist Accountants

Capital Gains Tax On Gifts Low Incomes Tax Reform Group

3 Ways To Defer Capital Gains Tax That Could Turn You A Profit