does maryland have a child tax credit

Each household could receive up to 3600 for each child under 6 years old and up to 3000 for each child between 6 and 17 years old. For any tax year the sum of all Endow Maryland tax credits including any carryover credits may not exceed the lesser of 50000 or the total amount of tax otherwise payable by the individual andor business for the tax year.

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

The Earned Income Tax Credit EITC is a benefit for working people with low to moderate income.

. For parents of children up to age five the IRS is paying 3600 per child half as six monthly payments and half as a 2021 tax credit. However Maryland does allow you to claim half of the Federal Earned Income Credit amount on Line 22 of your Form 502. Excess credits may be carried over for five 5 years.

Individuals that have at least 20000 in undergraduate or graduate student loan or both debt may qualify for the credit. The Child Tax Credit is for Federal purposes only. June 1 2019 805 AM.

Its a welcome boost to tens of millions of American families with young children. 311 West Saratoga Street Baltimore MD 21201. 1-800-332-6347 TTY 1-800-735-2258 2022 Marylandgov.

If you qualify for the federal earned income tax credit and claim it on your federal return you may be entitled to a Maryland earned income tax credit on the state return equal to 50 of the federal tax credit. In addition the legislation increases the refundable Earned Income Tax Credit to 45 for families and 100 for individuals. If you qualify for the federal earned income tax credit and claim it on your federal return you may be entitled to a Maryland earned income tax credit on the state return equal to 50 of the federal tax credit.

The Homestead Credit limits the increase in taxable assessments each year to a fixed percentage. Student Loan Debt Relief Tax Credit. Maryland Child Tax Credit.

In addition they allow a subtraction for Child and Dependent Care Expenses on Line 9 and a 3200. All working families will get the full credit if they make up to 150000 for a couple or 112500 for a family. For roughly 39 million households covering 88 of children in the United States the monthly checks will be automatic according to the Internal Revenue Service.

Maryland doesnt have a State Child Tax Credit. Find out whats happening in Annapolis with free real-time updates from Patch. The payments provide 178 million in relief to 400000 Marylanders.

The IRS has started distributing payments for the child tax credit. The American Rescue Plan increased the Child Tax Credit from 2000 per child to 3000 per child for children over the age of six and from 2000 to 3600 for children under the age of six and raised the age limit from 16 to 17. Funds contributed to our plans while considered completed gifts for tax purposes are eligible for federal gift tax exclusions.

Having received monthly Child Tax Credit payments in 2021 and any refund you receive as a result of claiming the Child Tax Credit is not considered income for any family. IRC 1341 Repayment. 41756 47646 married filing jointly with one qualifying child.

This money is not a loan. How the credit is calculated. Through December 2021 thousands of Maryland families recieved monthly payments deposited directly into their bank accounts of up to 300 per child under age 6 and up to 250 per child from ages 6 to 17.

The Earned Income Tax Credit also known as Earned Income Credit EIC is a benefit for working people with low to moderate income. That will send families up to 250 a month for every child between 6 and 17 years old and up to 300 a month for kids under 6. The rest of the tax credit worth between.

Every county and municipality in Maryland is required to limit taxable assessment increases to 10 or. The enhanced Child Tax Credit helped provide Maryland families with a total of 3600 for each child under 6 and 3000 total for each child. The total payment allowed under the Child Tax Credit is 3600 for children 0 to 5 and 3000 for children 6 to 17.

The Child Tax Credit has been expanded to reach additional children in Maryland many of whom are in families that do not realize theyre eligible for these funds. 15820 21710 married filing jointly with no qualifying children. In May 2019 Governor Larry Hogan R signed legislation to significantly increase the size of the states Credit for Child and Dependent Care Expenses expand the income limits and make the credit refundable for single filers with incomes.

The Child Tax Credit does not affect your other Federal benefits. Taxpayers with federal adjusted gross income of 6000 or less may claim a refundable credit of 500 for each qualifying child generally dependents under age 17. To help homeowners deal with large assessment increases on their principal residence state law has established the Homestead Property Tax Credit.

Like all 529 college savings plans Maryland 529 plans allow for contributions or payments that qualify for special 5-year averaging if a proper. Assets in Maryland 529 accounts have estate planning and tax benefits. You need to file a 2021 tax return to claim the remaining 2021 Child Tax Credit.

28000_FFY 7-21-2021 Child Tax Credit mp3. If you have additional questions regarding the Renters Tax Credit please contact the Departments Renters Tax Credit Program at sd atrentersmarylandgov or 410-767-5915. Independent Living Tax Credit You may be able to claim a credit towards your state income tax equal to 50 of the incurred expenses to make your home more accessible.

The Maryland earned income tax credit. Parents who filed taxes in 2019 andor 2020 and meet the income requirements started receiving advance Child Tax Credit payments on July.

Proposed Tax Cuts In Maryland Target Seniors Parents Dcist

Child Tax Credit Schedule 8812 H R Block

Tax Credit Available For Families With Children Dhs News

General Assembly Passes 61 Billion Budget As Top Leaders Gather To Sign Tax Breaks Into Law Maryland Matters

How Do I Choose A 529 Morningstar 529 College Savings Plan College Savings Plans Saving For College

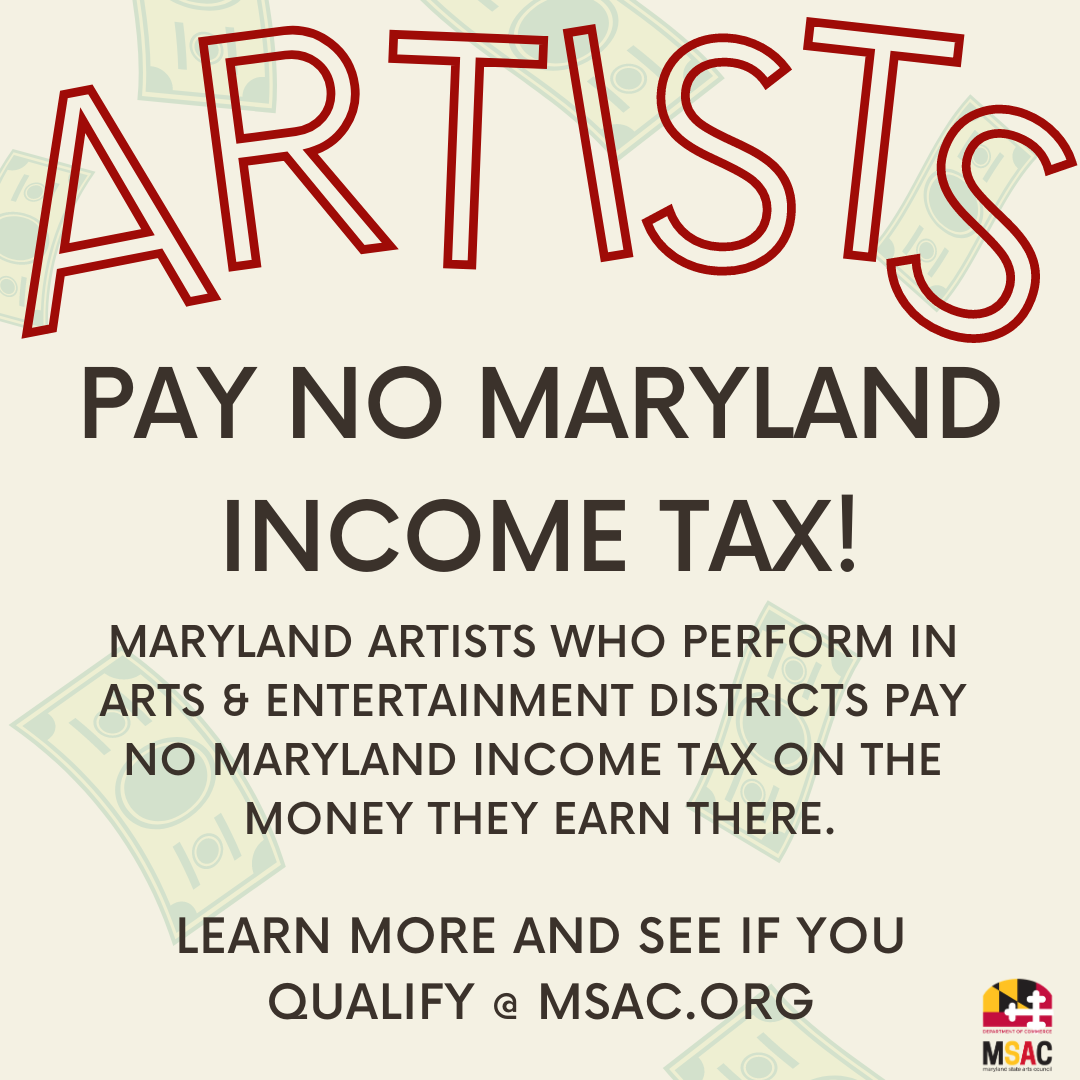

Tax Credit Station North Arts District

Tax Credit Available For Families With Children Dhs News

New 2022 Maryland Tax Relief Legislation Passed Sc H Group

Maryland Homestead Tax Credit Eligibility Application Deadline Is Dec 31 Tax Credits Maryland Application

When It Comes To 529s How Good Is Your State S Tax Benefit Morningstar College Savings Plans 529 College Savings Plan Savings Plan

Maryland A Southern State Baltimore Frederick Sales Campgrounds Tax Credit Md Page 64 City Data Forum Tax Credits Maryland Southern

Child Tax Credit 2021 8 Things You Need To Know District Capital

Maryland Historical Trust Sustainable Community Street View Historical

Maryland Improves Its Child And Dependent Care Tax Credit To Help More Families National Women S Law Center

Child Tax Credit Parents Struggle And Poverty Expected To Rise As Enhanced Benefits End Cnn Politics